Operating Expenses - Part I

It is reconciliation and estimate season.

How much are you paying in additional rent?

Are you sure your landlord has billed the correct amount?

-

RSF : Rentable Square Foot

Pro-Rata Share: Tenant’s RSF divided by the Building’s total RSF

Operating Expenses: The combination of services and utilities, insurance and taxes provided by the Landlord

NNN: Triple-Net

TICAM: Taxes, Insurance and Common Area Maintenance

CAM: Common Area Maintenance

Base Year: The calculation of actual operating expenses incurred by he Landlord during the calendar year in which the Tenant’s lease commences

Pass Through: Actual expenses incurred, which exceed the Base Year stop amount, over subsequent calendar years in the lase.

When it comes to Operating Expenses in a Lease Negotiation, there is a lot that can significantly impact the amount that the Tenant ultimately ends up paying in Additional Rent. For a busy business professional, it may be difficult to find time to comb through your lease to look for your correct pro-rata share, your base year, a gross up and/or cap on controllable operating expenses. Additionally, if no one has ever explained how these real estate terms affect your bottom line, you may not prioritize this task. Below we introduce these topics and the importance of each. If you have any questions or would like further information, please contact us by clicking the link below or at the bottom of the article.

In most multi-tenant office buildings, tenants pay a base rental amount and a pro-rata share of expenses incurred by the Landlord to operate the building. The Tenant’s Pro-Rata Share of expenses, which should be defined in the Lease Document, is simply the Tenant’s Rentable Square Footage (RSF) divided by the Building’s total RSF. So, if a Tenant occupies 10,000 RSF, and the Building has a total of 100,000 RSF, the Tenant’s Pro-Rata share would be ten percent (10%).

Example 1

For the Building to operate efficiently and be a desirable place for Tenants to conduct business, the Landlord must also provide services (i.e. janitorial, maintenance, utilities, landscaping, etc.) that come at a cost. Additionally, Landlords incur insurance premiums for property, casualty & liability coverage, along with municipal and county ad valorem taxes. This combination of provided services and utilities, insurance and taxes are commonly and collectively referred to as “Operating Expenses”.

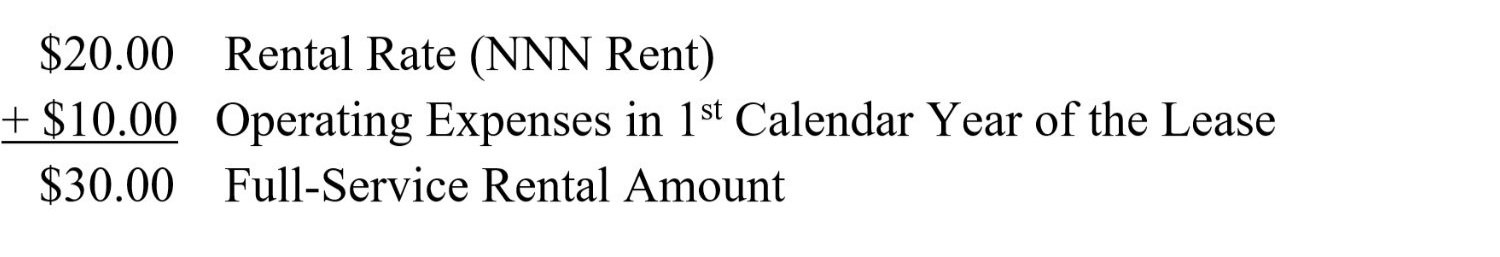

Let’s assume a full-service rental amount of $30.00/RSF ($30.00 per rentable square foot), with a $10.00/RSF of the $30.00/RSF attributable to Operating Expenses. The other $20.00 is generally referred to as the “Net” rental rate, the rate exclusive of the Operating Expenses, Taxes, and Insurance.

If your lease is not a full-service lease, you may encounter the following terms:

“Triple-Net” (NNN) lease, “Taxes, Insurance and Common Area Maintenance” (TICAM), and “Common Area Maintenance” (CAM), which sometimes are used interchangeably with the term Operating Expenses.

Example #2 - Full-Service Rental Rate/RSF Breakdown

Operating Expenses and Base Year

While often defined differently between Landlords and Tenants, the “Base Year” is, essentially, the calculation of actual operating expenses incurred by the Landlord during the calendar year in which the Tenant’s lease commences. In the example above, the $10.00/RSF allocation toward operating expenses would be known as the “Base Year”. It serves as a “stop” amount, allowing the Landlord to “pass through” to the Tenant, actual expenses incurred, which exceed the Base Year stop amount, over subsequent calendar years in the lease. Many factors can contribute to annual increases in operating expenses including inflation and increases or reductions in building services.

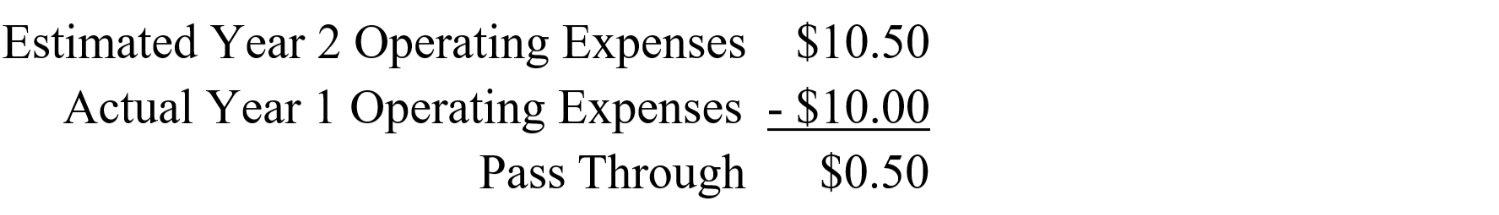

For our purposes, the Landlord assumes a 5% increase in Operating expenses. In our example, the actual, operating expenses for the first calendar year of the lease were $10/RSF and this amount was included in the Full-Service Rental Rate. With the assumed 5% increase in Operating Expenses, the annualized Estimated Operating Expenses for the second calendar year of the lease will be $10.50/RSF. Remember, the Tenant has a defined Base Year as specified in the Lease, with the $10/RSF included in the Full-Service Rental Rate. However, the Landlord will “Pass Through” the additional $0.50/RSF to tenant as “Additional Rent”. This is an important concept as the pass-through amount typically increases every year of the lease. Below you will see the Pass-Through Calculation and how it is applied to the Rental Rate.

Example #3a - Operating Expense/RSF Pass Through Calculation

Example #3b - Operating Expense/RSF Pass Through Calculation

The importance of reviewing a Tenant’s annual Base Year Operating Expense Reconciliation, provided by the Landlord, cannot be emphasized enough. It is critical to ensure the methodology follows the lease agreement and that the billed amount is accurate. We have found many errors over the years where the Base Year alone was not calculated correctly, resulting in improper, and in certain cases, egregious, Additional Rent charges to our Clients.

We hope this helps you understand the importance of reviewing these reconciliations and ensuring they match your Lease document. You can feel confident that you are paying an appropriate amount of Additional Rent or you may find savings for your company. Please reach out if you have any additional questions in regard to your operating expenses, existing lease or the market.

Don’t miss Part 2!

We will show you how to level the playing field with the Landlord and protect against rising controllable expenses.