Operating Expenses

It is reconciliation and estimate season.

How much are you paying in additional rent?

Are you sure your landlord has billed the correct amount?

In most multi-tenant commercial office buildings, tenants pay a base rental amount and a pro-rata share of expenses incurred by the Landlord to operate the building (i.e. janitorial, maintenance, utilities,, landscaping, etc.). Additionally, Landlords incur insurance premiums for property, casualty & liability coverage, along with annual taxation for municipal and county ad valorem taxes. This combination of operating expenses, insurance and taxes are commonly and collectively referred to as, “Operating Expenses”.

Depending on the building ownership structure and asset class of the building, Tenants may also see “TICAM”, “triple net” (NNN) and “common area maintenance”, used interchangeably with the term Operating Expenses. By way of example, a base rental amount might be based on a $30.00/RSF (per rentable square foot) number, with $10.00/RSF of the $30.00/RSF being applicable to Operating Expenses. The $20.00 is generally referred to as the “Net” rental. Or put another way, $20.00 net of operating expenses, taxes and insurance (NNN).All this means hiring an Owner’s Representative is more critical than ever.

Example #1 - Full Service Rental Rate Breakdown

The “Base Year” is the calculation of actual operating expenses incurred by the Landlord

This $10.00/RSF allocation towards operating expenses is known as the “Base Year” amount, or in certain cases, the “Expense Stop”. While often defined differently between Landlords and Tenants, the Base Year is in essence the calculation of actual operating expenses incurred by the Landlord, during the first 12 months of a Tenant’s leasehold tenancy. It essentially serves as a “stop” amount, allowing the Landlord to “pass through” to the Tenant, reasonable expenses incurred, which exceed the Base Year stop amount, over subsequent calendar years in the lease. The “pass through” charges are commonly referred to as “Additional Rent” in the lease. It is important for Tenants to review their annual Base Year Operating Expense Reconciliations provided by the Landlord, to ensure the methodology follows the lease agreement and that the billed amount is accurate. We have found many errors over the years where the Base Year alone was not calculated correctly, resulting in improper, and in certain cases, egregious, Additional Rent charges to our Clients.

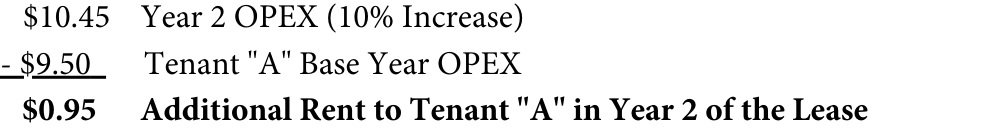

Example #2 - Operating Expense Pass Through Calculation

Most commercial leases are structured in such a way that Landlords “pass through” Operating Expenses to the Tenant using a Base Year Expense Stop method. A “pass through” is simply the increase in Operating expenses over the Base Year actual amount. This is an important concept as the pass-through amount typically increases every year of the lease. Example #2 shows how the pass-through amount is calculated.

Example #3 shows how the pass-through amount is applied to the rental rate.

Example #3 - Pass Through Plus Rent Calculation

A "gross-up" can level the playing field with the landlord.

To help level the playing field, a “gross-up” provision should be negotiated and included in the lease agreement. A “gross-up” provision requires the Landlord to increase certain categories of building operating costs which vary with changes in occupancy, known as “variable costs,” to reflect what such costs would have been if the building was fully or almost fully occupied (the most common gross-up percentage is 95%, though 100% or “fully” occupied is commonly used).

The Landlord “grosses-up” variable costs in the base year and in all comparison years. This ensures the Tenant is protected in comparison years from large increases in operating costs due purely to increases in building occupancy.

By way of example, Tenant "A" signs a new lease for 10,000 RSF in a 100,000 RSF building. During the Base Year, the Building is only 70% occupied, which equates to a Base Year operating expense amount that is lower than subsequent lease years, when the Building’s occupancy rate is likely to greater than 70%. As outlined in Examples #4 and #5, without a “gross-up” provision, a Tenant will have no protection against future excessive pass throughs.

The “gross-up” provision is especially important in new construction. In new construction, where much of the space is unoccupied and buildings have not been fully assessed for tax purposes, expenses and taxes will be lower for the first year or so. If these expense figures (including taxes) are used as a guideline and not "grossed-up" to a 95% occupied building and fully assessed value, tenants will be saddled with a disproportionate share of the excess burden.

Example #4 - Tenant “A” - New Lease with No Gross-Up Provision

*If you extrapolate this amount annually on a 5-year lease, this equals $104,000 in additional rent to Tenant "A" over the course of the lease.

Example #5 - Tenant “A” - New Lease with 95% Gross-Up Provision

Are you protected against rising controllable expenses?

Even with a gross-up provision as protection in the lease for operating expenses, a Tenant still needs a “Cap” on operating expense increases each year over year. This “Cap” also serves as an important mechanism that requires the Landlord to better control its costs. Operating Expenses are generally broken down in to two categories, controllable and non-controllable expenses. For simplicity, non-controllable expenses are typically defined as ad valorem taxes, property insurance, utilities and ice/snow removal. All other expenses generally fall under the controllable category. We advise that tenants attempt to negotiate a “Cap” on the controllable operating expenses. Not only does this “Cap” ensure that Landlords control their costs, but it also helps a Tenant more accurately budget for a "not to exceed" amount for annual additional rent. We have secured large savings for our Clients due to the fact that we successfully negotiated a “Cap” on controllable operating expenses; in certain instances, savings in excess of $100,000.